The Best Guide To Feie Calculator

Table of ContentsSee This Report about Feie CalculatorThe Of Feie CalculatorGetting The Feie Calculator To WorkFeie Calculator Fundamentals ExplainedThe Basic Principles Of Feie Calculator The smart Trick of Feie Calculator That Nobody is Talking AboutThe Facts About Feie Calculator Revealed

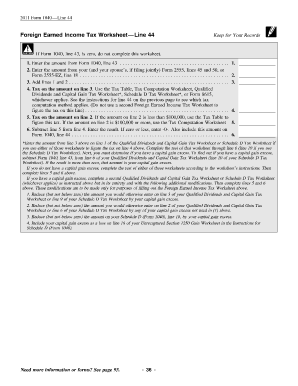

If he 'd regularly taken a trip, he would instead finish Component III, detailing the 12-month period he met the Physical Existence Examination and his travel background - Taxes for American Expats. Action 3: Coverage Foreign Income (Component IV): Mark gained 4,500 monthly (54,000 yearly). He enters this under "Foreign Earned Revenue." If his employer-provided housing, its value is likewise consisted of.Mark calculates the currency exchange rate (e.g., 1 EUR = 1.10 USD) and converts his wage (54,000 1.10 = $59,400). Given that he resided in Germany all year, the portion of time he resided abroad throughout the tax obligation is 100% and he goes into $59,400 as his FEIE. Finally, Mark reports complete salaries on his Form 1040 and goes into the FEIE as a negative amount on time 1, Line 8d, decreasing his taxed income.

Selecting the FEIE when it's not the most effective choice: The FEIE may not be perfect if you have a high unearned revenue, gain more than the exemption limitation, or reside in a high-tax nation where the Foreign Tax Obligation Credit History (FTC) may be much more helpful. The Foreign Tax Credit Rating (FTC) is a tax decrease method usually used combined with the FEIE.

Our Feie Calculator Statements

deportees to offset their U.S. tax debt with international revenue taxes paid on a dollar-for-dollar decrease basis. This implies that in high-tax nations, the FTC can typically eliminate united state tax obligation financial obligation completely. The FTC has constraints on eligible taxes and the optimum claim amount: Eligible taxes: Only revenue taxes (or tax obligations in lieu of revenue tax obligations) paid to foreign federal governments are eligible (Digital Nomad).

tax obligation responsibility on your international income. If the foreign tax obligations you paid exceed this limitation, the excess international tax can usually be continued for approximately 10 years or returned one year (through a modified return). Preserving exact records of foreign earnings and taxes paid is as a result vital to computing the appropriate FTC and maintaining tax obligation conformity.

expatriates to lower their tax obligation responsibilities. For example, if a united state taxpayer has $250,000 in foreign-earned earnings, they can leave out as much as $130,000 using the FEIE (2025 ). The continuing to be $120,000 may after that go through tax, yet the united state taxpayer can possibly use the Foreign Tax obligation Credit to offset the taxes paid to the international nation.

Feie Calculator for Beginners

He marketed his United state home to establish his intent to live abroad permanently and applied for a Mexican residency visa with his better half to aid fulfill the Bona Fide Residency Examination. Neil directs out that buying building abroad can be challenging without very first experiencing the area.

"It's something that people need to be actually attentive regarding," he says, and encourages deportees to be careful of usual errors, such as overstaying in the U.S.

Neil is careful to mindful to Anxiety tax united state tax obligation "I'm not conducting any business any kind of Illinois. The United state is one of the couple of nations that taxes its residents regardless of where they live, meaning that even if an expat has no earnings from U.S.

The Greatest Guide To Feie Calculator

tax returnTax obligation "The Foreign Tax Credit score permits individuals functioning in high-tax nations like the UK to counter their U.S. tax obligation by the quantity they have actually currently paid in taxes abroad," states Lewis.

The possibility of lower living costs can be alluring, but it often includes trade-offs that aren't right away obvious - https://www.huntingnet.com/forum/members/feiecalcu.html?simple=1#aboutme. Real estate, for instance, can be much more economical in some countries, but this can suggest compromising on facilities, security, or accessibility to reliable utilities and services. Cost-effective residential properties could be located in areas with inconsistent internet, restricted mass transit, or unstable medical care facilitiesfactors that can dramatically influence your day-to-day life

Below are some of the most frequently asked questions regarding the FEIE and other exemptions The International Earned Revenue Exemption (FEIE) permits united state taxpayers to leave out up to $130,000 of foreign-earned income from federal earnings tax obligation, decreasing their U.S. tax liability. To get approved for FEIE, you must meet either the Physical Existence Test (330 days abroad) or the Authentic Residence Examination (confirm your primary residence in a foreign country for an entire tax obligation year).

The Physical Presence Examination needs you to be outside the united state for 330 days within a 12-month period. The Physical Existence Test also requires united state taxpayers to have both a foreign income and Go Here a foreign tax obligation home. A tax obligation home is specified as your prime place for service or employment, despite your family's residence. https://www.goodreads.com/user/show/192466965-feie-calculator.

The Feie Calculator Diaries

A revenue tax treaty in between the U.S. and one more country can assist prevent dual taxation. While the Foreign Earned Income Exclusion decreases gross income, a treaty may provide added benefits for qualified taxpayers abroad. FBAR (Foreign Bank Account Record) is a called for declare united state people with over $10,000 in foreign monetary accounts.

The international gained revenue exemptions, sometimes described as the Sec. 911 exclusions, exclude tax on earnings earned from functioning abroad. The exemptions make up 2 components - an earnings exemption and a housing exemption. The adhering to Frequently asked questions review the advantage of the exclusions consisting of when both spouses are deportees in a basic manner.

The 9-Second Trick For Feie Calculator

The earnings exemption is now indexed for rising cost of living. The optimal yearly earnings exemption is $130,000 for 2025. The tax advantage excludes the earnings from tax obligation at lower tax obligation rates. Previously, the exclusions "came off the top" reducing revenue topic to tax at the leading tax rates. The exemptions may or might not decrease income made use of for other purposes, such as IRA limits, kid credit scores, personal exemptions, and so on.

These exclusions do not spare the wages from United States taxation yet merely supply a tax decrease. Note that a solitary person functioning abroad for every one of 2025 who made concerning $145,000 with no various other revenue will have gross income minimized to no - efficiently the exact same answer as being "free of tax." The exclusions are computed on an everyday basis.

If you went to organization conferences or workshops in the US while living abroad, income for those days can not be omitted. Your salaries can be paid in the United States or abroad. Your employer's location or the place where earnings are paid are not consider certifying for the exemptions. FEIE calculator. No. For US tax it does not matter where you keep your funds - you are taxable on your around the world revenue as a United States individual.